Our Solutions

Using advanced, scientific models, the best available data and quantitative research, we create model-driven products and solutions with practical applications for investors in need of better data so they can decide how to deploy capital in private equity and infrastructure markets while managing risk and benchmarking performance.

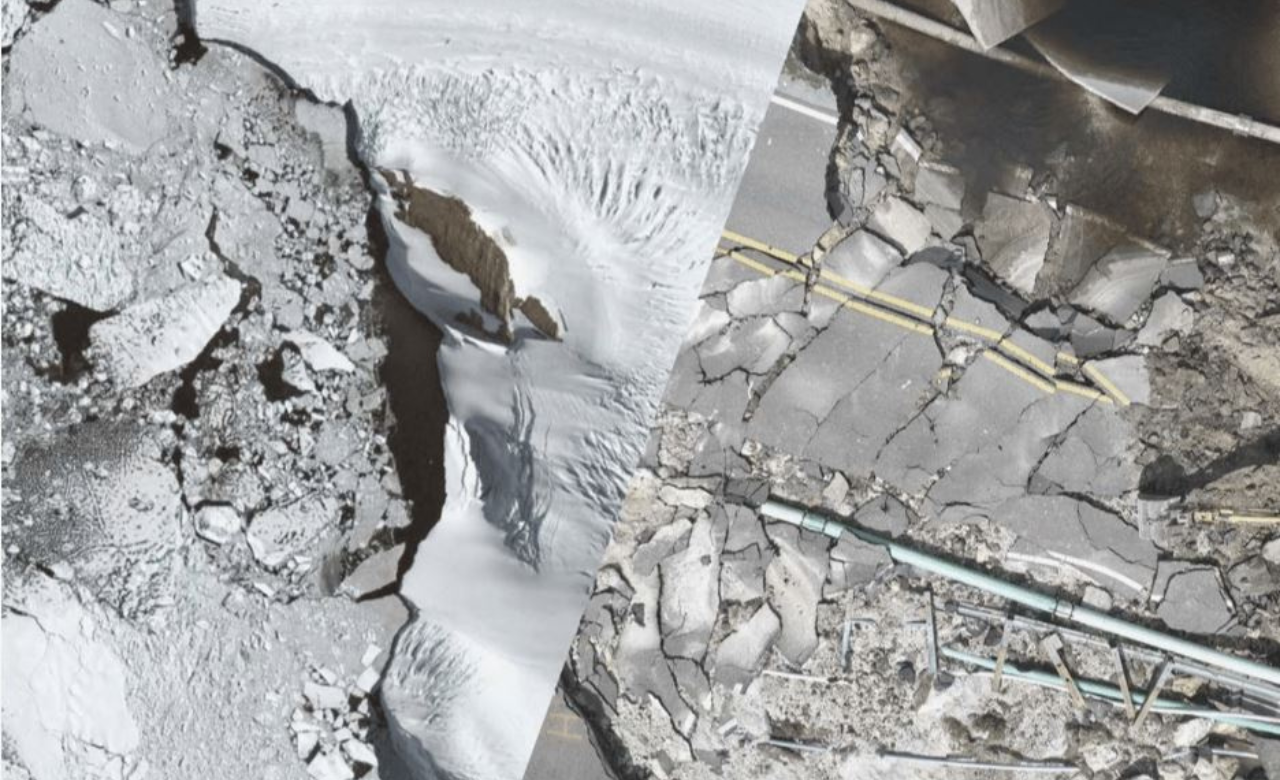

Private Assets Valuation

Assets Tracked

Prices Computed

Valuation Metrics

Segments

Asset-level private equity investment metrics across 60+ markets, by activity, customer model, revenue model, lifecycle and value chain with the PECCS® classification.

Our Clients

Trusted by sophisticated investors around the world since 2019

Client AUM

Fund managers use our data to launch new products, for deal due diligence, performance benchmarking and valuation.

Client Private Equity AUM

Asset Owners

Pension funds and insurers use our data to manage risk and allocations, select managers and review valuations.

Client Infrastructure AUM

Consultants

Consultants and OCIOs use our data to document strategies, select managers and track private market trends.

Experience our data firsthand: Request a demo now!

Contact our team to schedule a demo of the most advanced analytics platform in private assets.

Our Research

Latest News

Bloomberg: UK Watchdog Stalls on Fine That Threatens Thames Water’s Future

P&I 2024 Private Markets Conference, interview with Frédéric Blanc-Brude, Scientific Infra & Private Assets

Financial Times: Pension fund slashes value of its Thames Water stake by almost two-thirds

Bloomberg: Thames Water Valuation Cut Two-Thirds by Second-Biggest Investor